Our group implements strong safety features like chilly storage, encryption, and multi-factor authentication to safeguard person assets. The first proposal from Sebi calls for the introduction of a minimal resting time for orders. It is responsible for receiving tick by tick knowledge, executing algorithms, and putting the orders to the exchange matching engine.

Manage and replace the content material in your exchange website effortlessly to maintain customers informed. Efficiently handle liquidity through API integration, making certain clean https://www.xcritical.in/ trading operations. Authorize and oversee Know Your Customer (KYC) processes, enhancing user security and regulatory compliance. An admin panel that provides in-depth insights and control over your change.

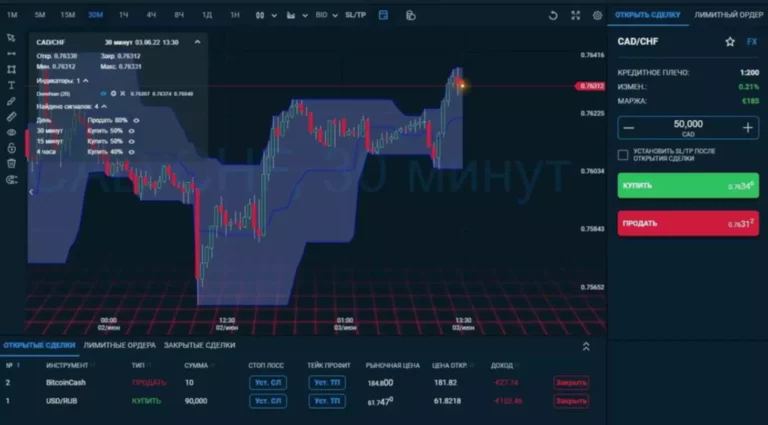

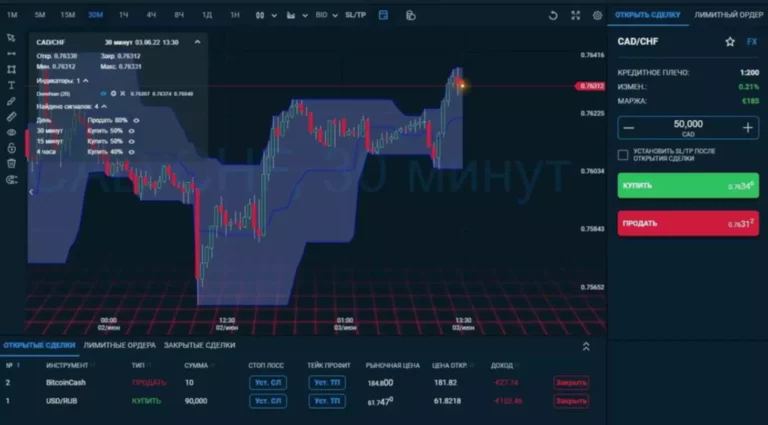

This permits traders to evaluate how their order execution will occur after submission. This is necessary as a outcome of the trades now get executed in fractions of seconds after it’s received by the change. So if a mistake is made at submission time, then the investor may not get an opportunity to switch the order. Eracom’s crypto-matching engine options assure the avoidance of a single level of failure in software through strong infrastructure and algorithms. Eracom’s crypto matching engine collects and propagate order books, quotes, sale & time, along with a market summary that includes OHLC costs and whole quantity. The software allows pre-order risk evaluation and documentation apparently along with expanded pluggable validation laws.

- Besides, these modifications were implemented voluntarily by the exchanges; they weren’t imposed by a regulator.

- This permits traders to evaluate how their order execution will happen after submission.

- Crypto trading engines are automated techniques that enable traders to access the cryptocurrency market from one platform.

- Taking into consideration all of these factors will make sure that you make the best choice when choosing an organisation to construct your crypto commerce engine.

- We look after the danger components of the inventory market to extend the revenue.

This can occur when there are not any sellers left for a stock with much less liquidity or if a share has hit an higher circuit. Depending on the type of orders obtained and the provision and demand, there are completely different eventualities that might be relevant. We will now clarify them and provide examples to better explain how are the orders matched in several circumstances. Algorithmic trading is evolving and for my part, it is too premature to regulate it,” he added. Baheti estimates that half of the HFT market would migrate to overseas platforms if the proposals are implemented. Implement auto-withdrawal limits to boost security and user fund safety.

What Are Crypto Buying And Selling Engines?

Again, the Market Order can’t be executed as there are not any sellers at any value. Let us take a look at an instance where the brand new order can’t be matched against existing orders. This normally occurs when there aren’t any buyers/sellers at the requested worth.

Our team uses the newest technologies and best practices to make sure that our product is delivered on time, on finances, and with the best level of efficiency and performance. Supports all asset lessons in a single system like equities to exotic, derivatives to digital belongings, and market fashions. Specific operations for tasks and hybrids mannequin, in addition to matching with flexible attributes. “Several norms proposed by Sebi wouldn’t have priority wherever in the world.

Centralized exchanges can scale their infrastructure and providers to accommodate growing consumer bases and trading volumes. Choosing the proper organisation to build a future-centric crypto trade engine is very important. Different organisations have different ranges of expertise, resources and expertise, so it’s important to evaluate them rigorously so as to find one that can correctly meet your wants.

Restrict Order

Depth of Market, aka the Order Book, is a window that reveals what number of open buy and sell orders there are at totally different prices for a safety. Let’s say the current value is $1, the DOM will show how many orders there are at $0.90, $1.05, and so on. Many centralized exchanges focus on regulatory compliance, which might result in partnerships, banking relationships, and legitimacy within the financial business. Once tested, we launch the platform and execute a comprehensive advertising strategy to attract in merchants and construct liquidity. The Stop Loss Orders are added to a separate Order Book on the Stock exchange and the order execution course of is totally different from the conventional orders.

Hitesh Hakani, director of Greeksoft Technologies, an algo buying and selling technology firm, identified that these recommendations particularly goal HFT. The market also has other kinds of algorithms, such as those which concentrate on executing giant sell orders efficiently, which might be less impacted. The ratio is a measure of how lots of the orders positioned in the system are literally executed. Some strategies are mentioned to use a lot of orders to provide the appearance of demand with out actually executing these orders.

As explained in What is Pre opening session in inventory market, a Call Auction mechanism is used to calculate the Open Price of the stock. We use a mix of advanced technologies, and a commitment to customer satisfaction to ensure that our software or utility meets the needs of our customers. Other proposals similar to minimal resting time have been thought-about by regulators such because the Australian Securities and Investments Commission and the European Commission but not adopted. Toronto-based TMX Group has launched a minimum resting period of 1 second.

Besides, these changes had been carried out voluntarily by the exchanges; they weren’t imposed by a regulator. The incentive to put cash into co-located servers or any other infrastructure that HFT traders require can be restricted if the regulator implements the proposed modifications, he said. Sebi on 5 August invited public comments on seven methods to allay the concern that high-frequency traders have unfair access to the trading system of Indian exchanges. It is based on the number of open purchase and promote orders for a given asset such as a stock or futures contract. The larger the quantity of those orders, the deeper or extra liquid, the market is considered to be. It is answerable for all required checks, risk management, monitoring, and centralized control.

Order Kinds Of Our Centralized Exchange Improvement Companies

If the measures are applied, it’ll hit liquidity, improve cost of trading and traders might shift to utilizing comparable products in overseas markets similar to Singapore and Dubai, they said. These exchanges provide customer support providers, enhancing consumer satisfaction by aiding with account-related points, commerce disputes, and technical issues. Users can withdraw their funds and cryptocurrencies from the exchange to their external wallets. Security measures, corresponding to two-factor authentication (2FA) and withdrawal limits, could additionally be in place to guard user funds throughout this course of. The order execution process is totally different in the pre open session and the normal market timings.

Gemini’s ActiveTrader™ crypto trading platform offers superior charting, a quantity of order varieties, central limit order books that observe a price-time precedence mannequin, and more. Gemini also provides a well-known, comprehensive, and turn-key resolution for liquidity providers to soundly and seamlessly commerce crypto. Crypto trading engines are automated methods that allow merchants to entry the cryptocurrency market from one platform. Hivelance is the leading Cryptocurrency Exchange trading engine developer with years of expertise. We provide a crypto commerce engine with premium security features and excessive level supply code.

Depth Of Marketdom

Our advanced algorithms and infrastructure ensure that trades are executed in real-time and at the greatest possible value. In addition, we offer a range of extra companies, together with threat administration, compliance monitoring, and reporting tools, to assist our shoppers manage their trading activities extra effectively. It acts as an intermediary, providing user-friendly interfaces and liquidity.

Bisq is a decentralized exchange that makes use of peer-to-peer networking and multi-signature escrow to facilitate buying and selling without a third get together. The platform is non-custodial and incorporates a human evaluate process to ensure a secure and successful commerce. It also provides near-anonymity and is designed to protect customers’ information and funds, whereas allowing them to get started in minutes with none identity verification. They can also be used for automated buying and selling, allowing traders to set up their own custom buying and selling methods and automate their trading course of. Crypto trading engines are designed to maximise earnings and decrease losses for traders, and many of them provide advanced options like charting instruments, indicators, and real-time data feeds.

Why Choose Osiz As Your Centralized Trade Improvement Company?

With a group of skilled blockchain builders, we provide comprehensive options, together with an order matching engine, wallet integration, sturdy security features, and a scalable architecture. This results in a extremely practical, secure, and customised change that caters particularly to your unique necessities. With a confirmed monitor record and dedication to excellence, Osiz is your companion on the earth of centralized crypto trade improvement. Dash 2 Trade is a crypto trading engine that makes a speciality of automated trading and portfolio management. Dash 2 Trade also presents competitive charges, 24/7 buyer assist, safe buying and selling and storage solutions. As a number one fintech firm, our order matching engine service provides a quick, dependable, and efficient resolution for matching buy and promote orders.

Liquidity Api Management

Mizar is a great trading platform designed to permit anybody to trade by tapping into the wisdom of their friends. It’s a two-sided marketplace that connects traders with methods from professional and experienced traders. With Mizar, you can copy the strategies of high merchants, handle and automate your orders on different exchanges from a single place, and entry crypto exchange engine a extensive range of buying and selling tools and insights. Additionally, Mizar has a dependable and safe trading platform that is backed by a group of experienced safety professionals. We take care of the danger elements of the stock market to increase the revenue. We provide skilled companies that fulfill the requirement of shoppers.

The trade’s order matching engine matches buy and sell orders based mostly on value and time. When an order is matched, the trade is executed, and the corresponding quantities of cryptocurrencies are transferred between the buyer and the seller. Catalyzing cryptocurrency markets with progressive solutions, Osiz is a premier centralized trade development firm that gives revolutionary options for your business. Our pool of builders with expertise in blockchain growth over eight years will help you through the tip to end process.

Leave a Reply